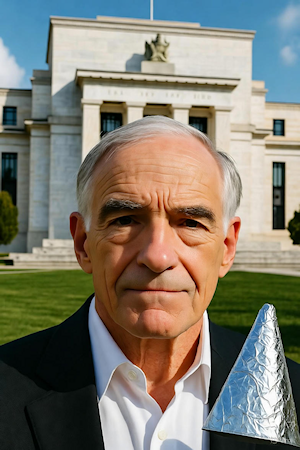

Ron Paul's "Audit the Fed" Campaign: What Happened (and Why It Matters)

Ron Paul's push for a full, independent audit of the Federal Reserve was a hallmark of his congressional tenure (1987–2013), but it never resulted in the comprehensive transparency he envisioned. He introduced versions of the Federal Reserve Transparency Act (H.R. 1207 in 2009, and iterations through 2012) repeatedly, arguing that the Fed's "most crucial activities"—like monetary policy deliberations, open market operations, discount window lending, and foreign agreements—were shielded from meaningful oversight. Paul framed it as a matter of accountability: The Fed, a quasi-private entity created by Congress in 1913, wields immense power over the economy without full congressional scrutiny.

Ron Paul's push for a full, independent audit of the Federal Reserve was a hallmark of his congressional tenure (1987–2013), but it never resulted in the comprehensive transparency he envisioned. He introduced versions of the Federal Reserve Transparency Act (H.R. 1207 in 2009, and iterations through 2012) repeatedly, arguing that the Fed's "most crucial activities"—like monetary policy deliberations, open market operations, discount window lending, and foreign agreements—were shielded from meaningful oversight. Paul framed it as a matter of accountability: The Fed, a quasi-private entity created by Congress in 1913, wields immense power over the economy without full congressional scrutiny.

The Fed does undergo regular audits, but they're limited:

- Financial audits: Conducted annually by independent external auditors (e.g., Deloitte) on the Fed's balance sheets, operations, and reserves. These are public and cover "bean-counting" like assets/liabilities.

- GAO audits: The Government Accountability Office (nonpartisan arm of Congress) can review specific areas, like emergency lending (thanks to Dodd-Frank in 2010, which stemmed from Paul's efforts). This revealed, for instance, $16 trillion in low-interest loans to banks during the 2008 crisis, including foreign ones.

But Paul's bill sought a one-time, full GAO audit of everything, including policy decisions and foreign dealings, with results reported directly to Congress within 90 days. Critics (e.g., Fed Chair Ben Bernanke) called it a "nightmare" that would politicize the Fed, exposing deliberations to short-term pressure and undermining its independence—which studies show leads to lower inflation and better economic stability.

Key Milestones in Paul's Efforts

Here's a quick timeline of his major pushes and outcomes:

|

Year |

Event |

Outcome |

|

2009 |

Introduces H.R. 1207 post-financial crisis; Senate version by Bernie Sanders (S. 604). Paul amends H.R. 3996 to lift GAO restrictions. |

Partial win: Amendment passes committee, but full bill stalls. Influences Dodd-Frank's targeted audit of crisis loans. |

|

2011–2012 |

Holds subcommittee hearings; reintroduces "Audit the Fed" bill. Gains bipartisan momentum amid Occupy Wall Street and Tea Party. |

House victory: Passes House 327–98 (bipartisan, July 2012)—Paul's "last hurrah" before retirement. Senate (Dem-controlled) kills it; zero chance of passage. |

|

2015–2016 |

Son Rand Paul takes up the torch with S. 2232. |

Senate block: Fails cloture 53–44 (Jan. 2016); even Sanders votes yes, but Democrats (fearing political meddling) kill it. |

|

2023–2024 |

Rand Paul & Chuck Grassley reintroduce Federal Reserve Transparency Act (S. 3516/H.R. 24). |

Referred to committee: No floor vote yet; supported by groups like Heritage Foundation and Campaign for Liberty. As of Nov. 2025, still pending amid GOP Senate push. |

Why No Full Audit? The Political Reality

- Bipartisan Resistance from Leadership: Both parties' establishments (and the Fed itself) viewed it as a threat to independence. Bernanke warned it could invite "political interventions," echoing historical precedents where politicized central banks fueled inflation (e.g., pre-Volcker era). Even pro-audit votes like Sanders' were symbolic—full passage risked alienating Wall Street donors.

- Partial Compromises: Paul's advocacy did force changes, like the 2010 GAO crisis audit, which exposed foreign bank bailouts (e.g., $500B to European lenders). But the core exemptions on monetary policy remain.

- Ongoing Momentum: The bill's reintroduced every session, now with broader GOP backing (e.g., Ted Cruz, Mike Lee). Ron Paul himself predicted in 2016 that another crisis could revive it—COVID's $4T+ QE binge reignited calls, but no dice yet.

You're right to be skeptical of "audits & transparency" rhetoric—it's often performative. Paul's fight highlighted the Fed's opacity (e.g., no real-time disclosure on FOMC deliberations), fueling distrust. If you're tying this to broader cronyism chats (like our Fed thread), it's a perfect hook: Demand the full audit to expose how unelected bankers (domestic and via global swaps) rig the game. Want to draft a FB post on this? Or dive into the 2010 GAO report details?

For more: Check Paul's book End the Fed or the Mises Institute's breakdowns

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.

Comments